COMPREHENSIVE TAX EXPENDITURE DATA TO INCREASE TRANSPARENCY AND ADVANCE REFORMS

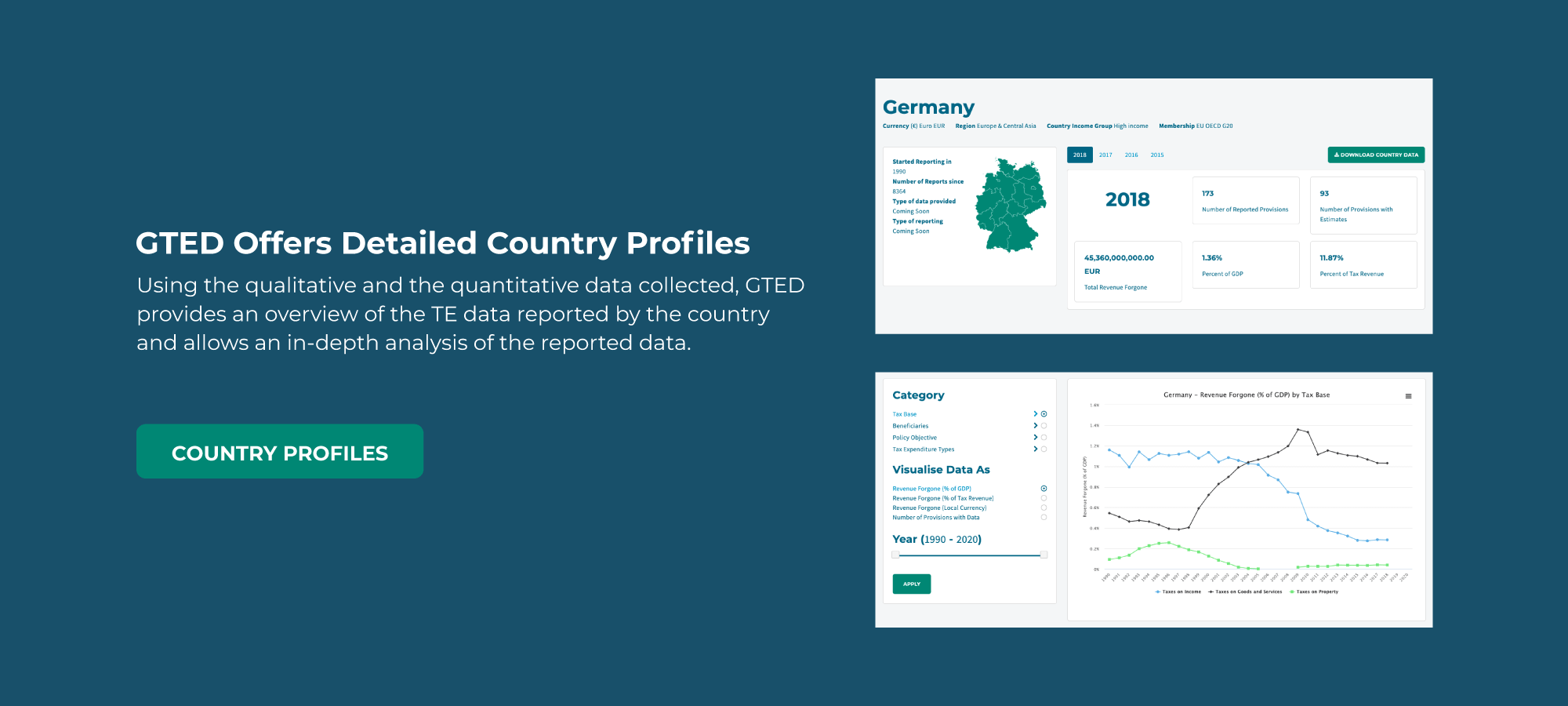

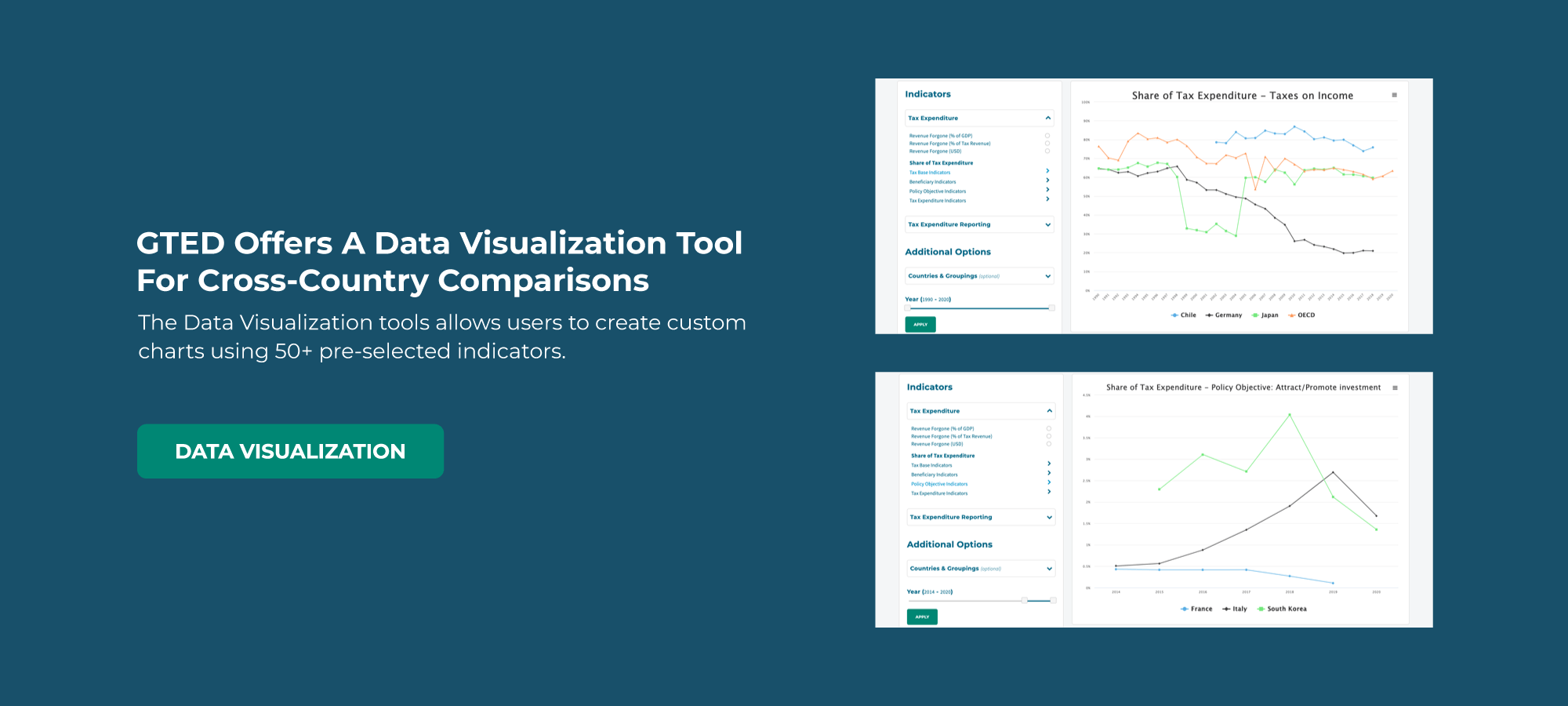

The GTED provides timely and consistent information on preferential tax treatments such as exemptions, deductions, credits, deferrals and reduced tax rates that are implemented by governments worldwide to promote different policy goals. The GTED aims to improve reporting, enhance scrutiny, and, ultimately, to contribute to the design of effective and fair tax expenditures across the world.

Project by